TERM LIFE INSURANCE WHAT IS IT ?

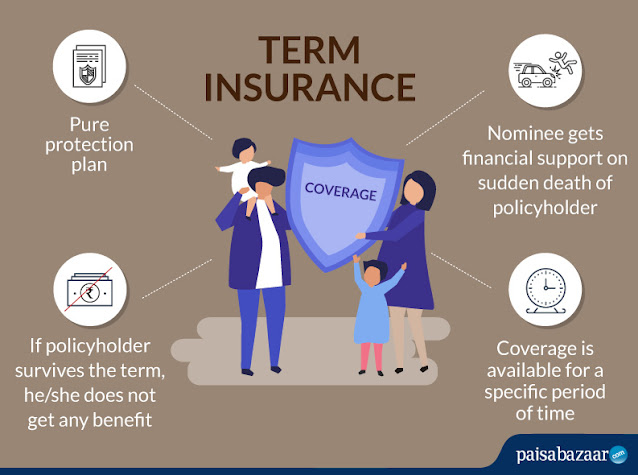

Term insurance is also a insurance policy, which offers financial coverage to your family/nominee in case of your death. It makes sure that your family is well-taken care of after your demise. , you can cover disease and disability under term insurance as well. It's one of the best ways to protect the financial future of your family in a cheap manner.

WHY IS IT IMPORTANT TO INVEST IN TERM INSURANCE

With the frequency of accidents and diseases increasing per day, your plan of living a long life may seem far fetched. That means, if you die, your family should have a financial backup to take care of their needs. That's why investment experts in the industry suggest investing in a term insurance plan and that too at a young age.Term Insurance is very important to protect your family with uncertinity and future Happenings.

Benefits of Term Life Insurance

-

Death Benefit: In the unfortunate event of death of life insured during policy term, the nominee shall receive the Total Payout as a Lump sum amount or a combination of Lump sum & Monthly amount.

-

Lump sum amount to take care of immediate financial liabilities.

-

Monthly income to sustain the family lifestyle.

-

Tax Benefit: The premiums paid for Term Life Insurance are Tax free under section 80(C) upto an amount of Rs 1,50,000.

-

Rider Benefits: Riders are an important addition to the basic plan offering & provide an option to customize the coverage to the life insured.

-

Accidental Death Benefit rider offers an additional sum assured over the base plan offering in case death occurs due to an accident.

-

Accidental Disability rider offers an immediate lump sum payment on occurrence of any disability due to an accident.

-

Critical Illness rider offers an additional sum assured over the base plan offering if the life insured is diagnosed with one of the critical illnesses mentioned in the rider.

-

Waiver of Premium rider offers the waiver of all policy premiums in case the life insured is diagnosed permanent disability or critical illness.

-

Option to increase Death benefit: Certain plans have offerings where the life insured can increase the life cover at key stages in life like marriage , birth of child.

Term Insurance Companies

-

Bharti Axa Term Insurance

-

Birla Sun Life Term Insurance

-

Canara HSBC Term Insurance

-

Exide Life Term Insurance

-

HDFC Term Insurance

-

ICICI Term Insurance

-

IDBI Federal Term Insurance

-

Kotak Term Insurance

-

LIC Term Insurance

-

Max Life Term Insurance

-

PNB MetLife Term Plan

-

Reliance Nippon Term Insurance

-

SBI Term Insurance

|

Insurers |

Term Plan |

Claim Settlement Ratio |

Max Maturity Age |

Premium (for a cover of 1 crore) |

|

Aditya Birla Sun Life Insurance |

ABSLI LifeShield Plan |

97.1% |

75 years |

Rs. 623/month |

|

Aegon Life Insurance |

iTerm |

96.5% |

100 years |

Rs. 479/month |

|

Bajaj Allianz General Insurance |

Life Cover |

95% |

85 years |

Rs. 458/month |

|

Canara HSBC OBC Life Insurance |

iSelect+ LumpSum |

95.2% |

99 years |

Rs. 480/month |

|

EXIDE Life Insurance |

Exide Life Smart |

97% |

55 years |

Rs. 926/month |

|

Edelweiss Tokio Life Insurance |

Zindagi Plus+ Lump sum |

97.8% |

80 years |

Rs. 478/month |

|

Future Generali India Insurance |

Future Generali Flexi Online Term-Lumpsum |

95.2% |

75 years |

Rs. 486/month |

|

HDFC Life Insurance |

Life Option |

99% |

85 years |

Rs. 709/month |

|

ICICI Prudential Life Insurance |

iProtect Smart Lumpsum |

98.6% |

85 years |

Rs. 647/month |

|

IndiaFirst Life Insurance |

e-Term Plan |

94.2% |

65 years |

Rs. 422/month |

|

Kotak Life Insurance |

e-Term |

97.4% |

75 years |

Rs. 654/month |

|

Max Life Insurance |

Smart Term Plan Life Cover |

99.22% |

85 years |

Rs. 571/month |

|

PNB Metlife Life Insurance |

Mera Term Plan-Full Lumpsum payout |

97.16% |

99 years |

Rs. 585/month |

|

Reliance Nippon Life Insurance |

Reliance Digi-Term |

97.71% |

65 years |

Rs. 500/month |

|

SBI Life Insurance |

eShield |

95.03% |

80 years |

Rs. 589/month |

|

Tata AIA Life Insurance |

TATA Maha Raksha Supreme Lumpsum |

99.1% |

85 years |

Rs. 927/month |

Note- Rates Will Be As Per The Age Of The Person .

When is the Right Time to Buy a Term Life Insurance Policy?

The ideal time to buy the online term plan is as early as possible. The early one buys the better it will be. Buying the right term plan ensures that you obtain the desired life coverage. Moreover, buying term life insurance policy at an early stage of life means that the insurance premiums will be low compared to the times if bought at a later stage of life.

When is the Right Time to Buy a Term Life Insurance Policy?

The ideal time to buy the online term plan is as early as possible. The early one buys the better it will be. Buying the right term plan ensures that you obtain the desired life coverage. Moreover, buying term life insurance policy at an early stage of life means that the insurance premiums will be low compared to the times if bought at a later stage of life.

When is the Right Time to Buy a Term Life Insurance Policy?

The ideal time to buy the online term plan is as early as possible. The early one buys the better it will be. Buying the right term plan ensures that you obtain the desired life coverage. Moreover, buying term life insurance policy at an early stage of life means that the insurance premiums will be low compared to the times if bought at a later stage of life.

When is the Right Time to Buy a Term Life Insurance Policy?

The ideal time to buy the online term plan is as early as possible. The early one buys the better it will be. Buying the right term plan ensures that you obtain the desired life coverage. Moreover, buying term life insurance policy at an early stage of life means that the insurance premiums will be low compared to the times if bought at a later stage of life.

When is the Right Time to Buy a Term Life Insurance

Policy?

The ideal time to buy the online term plan is as early as possible. The early one buys the better it will be. Buying the right term plan ensures that you obtain the desired life coverage. Moreover, buying term life insurance policy at an early stage of life means that the insurance premiums will be low compared to the times if bought at a later stage of life.

When is the Right Time to Buy a Term Life Insurance

Policy?

The ideal time to buy the online term plan is as early as possible. The early one buys the better it will be. Buying the right term plan ensures that you obtain the desired life coverage. Moreover, buying term life insurance policy at an early stage of life means that the insurance premiums will be low compared to the times if bought at a later stage of life.

When is the Right Time to Buy a Term Life Insurance Policy?

The ideal time to buy the online term plan is as early as possible. The early one buys the better it will be. Buying the right term plan ensures that you obtain the desired life coverage. Moreover, buying term life insurance policy at an early stage of life means that the insurance premiums will be low compared to the times if bought at a later stage of life.

When is the Right Time to Buy a Term Life Insurance Policy?

The ideal time to buy the online term plan is as early as possible. The early one buys the better it will be. Buying the right term plan ensures that you obtain the desired life coverage. Moreover, buying term life insurance policy at an early stage of life means that the insurance premiums will be low compared to the times if bought at a later stage of life.

Riders are the add-on coverage which can be purchased by the policyholder along with the basic term Plan in order to enhance the coverage of the policy. There are various online term insurance plans which offer riders as an in-built feature of the policy. Before zeroing in on an online term plan it is very important to check what are the in-built riders and add-on riders offered under term insurance policy. The rider benefit can be availed by paying an extra premium to the insurer along with the basic premium of the term policy. Some of the riders offered by the term Plan are:

Critical Illness Rider

Critical illness riders cover many illnesses that are deadly in nature. You can buy this rider if you are prone to any such illness. Before taking the rider, you can always check the additional cost and decide accordingly.

Accidental Death Benefit Rider

Benefits of Accidental Death Rider:

-

Provides added financial protection.

-

Some insurance policies provide this as an inbuilt feature.

Accidental Total and Permanent Disability Rider

-

Income Benefit Rider

This rider offered by term plan is specifically designed to generate income after the demise of the life insured. Under this rider benefit, the insured’s family receives additional income every year for the tenure of 5-10 years, along with the regular sum assured amount.

This is an add-on rider benefit offered by the term insurance wherein, an extra sum assured amount is paid to the policyholder in case; he/she suffers from an accidental permanent or partial disability which leads to unemployment. Generally, the insurance companies offer 10% or more sum assured amount per year in order to compensate for the regular income that may happen due to total and permanent disability of the policyholder.

What is not covered in term insurance?

Before purchasing any term plan, it is very important for policy buyers to go through the terms and conditions of the policy and check all the exclusions mentioned in the policy documents. However, term insurance Plan come with only one exclusion i.e.

Suicide Exclusion: In case, the life insured (sane or insane) commits suicide within 12 months (1 years) from the date of policy inception or from date of revival of policy, the policy terminates immediately. In such cases, the beneficiary of the term insurance policy receives only the total term life insurance premium amount paid by the insured from the insurance company (inclusive of extra premium, if any, but exclusive of applicable charges and taxes imposed by the government).

Apart from the above, there are other exclusions as well, which come under critical illness riders. If any of these exclusions are found at the underwriting stage of the term insurance policy, then no benefit will be offered. Let’s take a look at the exclusions, which come under critical illness riders.

-

Any health condition or ailment that has been suffered by the life insured/ were diagnosed/or receiving treatment within 48 months before the policy initiation date, the insurance provider will not provide insurance protection under critical illness rider of term plan.

-

The critical illness rider offered by term plan does not provide coverage in case of intentional self-inflicted injuries, self-abuse, attempted suicide, psychological disorder, etc.

-

The external congenital anomaly, which is in the accessible and visible part of the body, is not covered under the critical illness rider offered by the term insurance plan.

-

The critical illness rider offered by the term insurance plan, does not provide any benefit in case the life insured delays the medical treatment in order to avoid the waiting period.

-

No critical illness rider benefit is offered by the term plan in case of invasion, war, act of foreign enemy, civil war, revolution, rebellion, strike, mutiny, etc.

-

The life insured will not be entitled to avail the benefit of a critical illness rider offered by term plan, in case the insured is an alcoholic or addicted to drugs and narcotics.

-

Any man-made disasters such as wars or rights which result in the loss of life are not covered under the critical illness rider of an online term plan. Any suffering or damage resulting due to the carelessness of the people is not counted by the insurance company.

-

Thus, no coverage is offered to the insurance holder in such cases.

-

Term Plan does not offer any critical illness rider coverage in case of involvement of the life insured in extreme and risky sports activity such as scuba diving, bungee jumping, trekking, rock climbing, paragliding, skydiving, water sports activity, etc.

-

Term Plans do not offer any critical illness rider in case of sexually transmitted diseases such as AIDS/HIV, the claim made by the beneficiary of the policy is rejected by the insurance company.

-

The term insurance company does not provide any critical illness rider in case of any casualty resulting from the involvement of law violation or unlawful activities. The beneficiary of the policy will be eligible for the claim only in case it is a sudden and unintentional act.

Comments

Post a Comment